Proposal

2023-12-07

Group members

| Name | UNI | Contact |

|---|---|---|

| Pei Tian | pt2632 | pei.tian@columbia.edu |

| Mengxiao Luan | ml5018 | ml5018@cumc.columbia.edu |

| Sitian Zhou | sz3213 | sz3213@cumc.columbia.edu |

| Yuzhe Hu | yh3676 | yh3676@cumc.columbia.edu |

| Shuchen Dong | sd3731 | sd3731@cumc.columbia.edu |

Tentative project title

BillionaireOmics: Decoding the World’s Richest

Motivations

- Gain a comprehensive view of billionaire wealth dynamics.

- Unravel factors contribute to billionaire success.

- Explore implications for wealth distribution and economic conditions.

- Contribute to the understanding of wealth distribution patterns.

Intended final products

- Report document

- GitHub Page

- Shiny App for visualization

- Video

Anticipated data sources

Industry Economics

Country Economics & Geography

Planned analysis & visualizations

Data Cleaning

Quality control, format consistency maintenance for data usage

Select variables to reduce redundancy

Tidy key variables to ensure the feasibility of joining operation

EDA, Categorical

Regarding general distribution:

What is the numeric distribution of billionaires of different states?

- number of billionaires with different wealth amounts

- number of billionaires through different approach(self-made or not)

- number of billionaires with different wealth status(increase or decrease)

Regarding individual details:

What is the distribution of billionaires when divided by demographic information?

- number and average wealth of billionaires in different gender

- number and average wealth of billionaires across age groups

- number and average wealth of billionaires in different countries(residence and nationality)

Regarding industry and economic development:

What is the potential relationship between billionaires and their business industries?

- number and average wealth of billionaires distributed in different business industries(regarding the economic development and taxation of the industry)

EDA, Longitudinal

GDP-Temporal Wealth Patterns

Examine the rise and fall of billionaire wealth across different economic cycles, including booms, busts, and recoveries.

Industry-Lifecycles and Billionaire Wealth

Explore how technological disruptions in various sectors impact the net worth and ranking of billionaires over time.

Geo-Economic Shifts

Track shifts in the geographic distribution of billionaires over time and correlate these with changing economic powers and policies in different regions.

Analyze trends in wealth concentration in relation to global economic shifts, such as the rise of (Asia?) as an economic powerhouse.

Pandemic Response and Wealth Elasticity

Measure the elasticity of billionaire wealth in response to the COVID-19 pandemic.

Compare the wealth growth rates of billionaires in healthcare and technology before, during, and after the pandemic to those in more traditional industries.

EDA, Geographic

Interactive visualization for top-ranked billionaires in different regions (countries, continents)

Interactive visualization for GDP of different countries in different years

Compare billionaire distribution in different regions (such as average wealth, gender composition)

Provide geographic visualization interface for other analysis results

Hypothesis Testing

Compare wealth between age groups: ANOVA (check assumptions, transformation may be applied)

Compare wealth between gender groups: T-test

Compare the proportion of female billionaires in 2013 and 2023: Two sample prop test

Compare the proportion of billionaires in a certain industry (eg. Tech) in 2013 and 2023: Two sample prop test

If result is significant, we could further look into the industry GDP dataset to explore the trend of that industry

Regression

When the topic of billionaires comes up, one can’t help but wonder what factors led them to become billionaires. Here, multiple linear regression will be adapted to analyse the problem. To be specific, the net worth of billionaires is going to be selected as the dependent variable, combining factors that may be related to it that can be quantified as the dependent variables, such as: the corresponding age of billionaires, gender, years of education, the total annual GDP of the country they belong to, the total tax rate of the country they belong to, and potentially other factors. Based on the linear regression results, we will adjust the factors accordingly, interpret the results in real context, and evaluate the usability of the model to fit the available data through evaluation criteria such as R-squared and AUC.

Coding challenges

- Data tidying challenge: handle key variables with the same meaning but different exact values from different datasets.

- Website design: build a fancier home page with advanced settings.

- R-Shiny interactive dashboard: apply R-Shiny to build an interactive dashboard.

- Model fitting: Variable selection and interpretation could be a challenge.

- GitHub collaboration: branch management via Git.

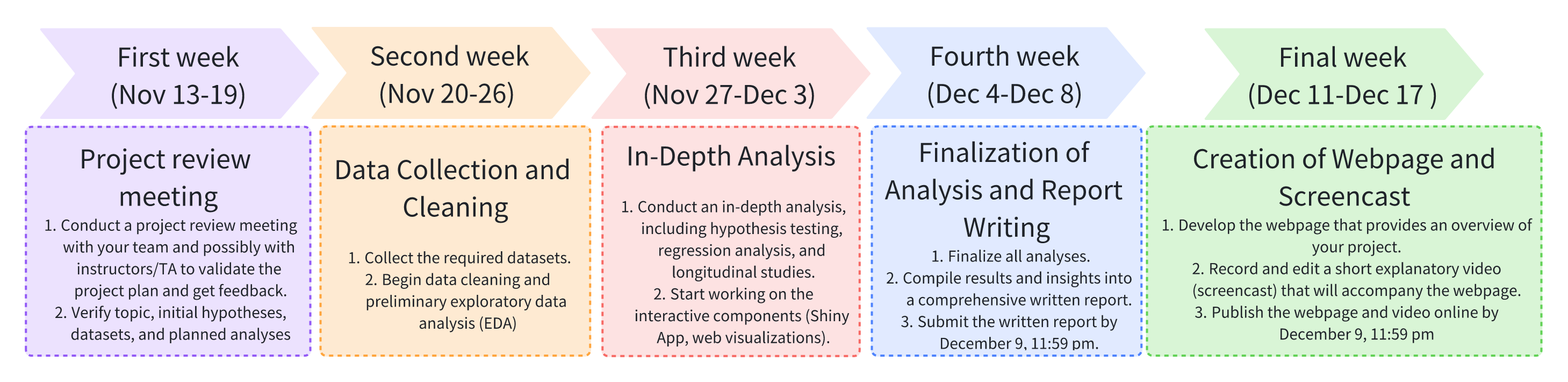

Planned timeline